Are Hospital Bills Tax Deductible . for 2023 tax returns filed in 2024, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their. claiming medical expense deductions on your tax return is one way to lower your tax bill. you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). if you recently spent thousands on hospital bills or physical therapy, you may be wondering if you qualify for any deductions. medical expenses are the costs to treat or prevent an injury or disease, such as health insurance premiums, hospital visits, and. While you can receive a.

from templates.rjuuc.edu.np

claiming medical expense deductions on your tax return is one way to lower your tax bill. if you recently spent thousands on hospital bills or physical therapy, you may be wondering if you qualify for any deductions. While you can receive a. for 2023 tax returns filed in 2024, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their. medical expenses are the costs to treat or prevent an injury or disease, such as health insurance premiums, hospital visits, and. you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi).

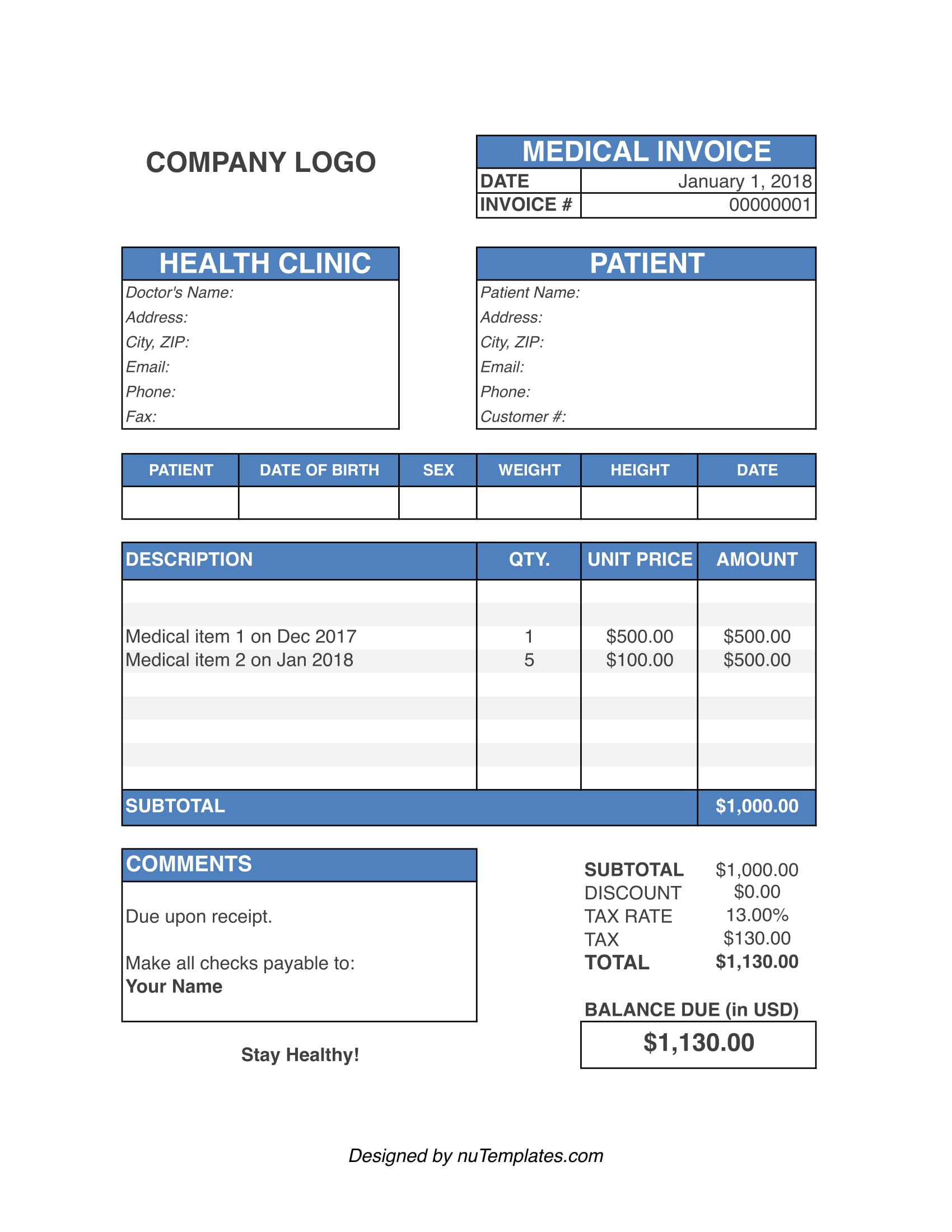

Medical Invoice Template Free Download

Are Hospital Bills Tax Deductible medical expenses are the costs to treat or prevent an injury or disease, such as health insurance premiums, hospital visits, and. medical expenses are the costs to treat or prevent an injury or disease, such as health insurance premiums, hospital visits, and. if you recently spent thousands on hospital bills or physical therapy, you may be wondering if you qualify for any deductions. While you can receive a. you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). for 2023 tax returns filed in 2024, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their. claiming medical expense deductions on your tax return is one way to lower your tax bill.

From invoicewriter.com

How to Make a Hospital Bill Invoice Invoicewriter Are Hospital Bills Tax Deductible you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). if you recently spent thousands on hospital bills or physical therapy, you may be wondering if you qualify for any deductions. for 2023 tax returns filed in 2024, taxpayers. Are Hospital Bills Tax Deductible.

From www.pinterest.com

Medical Expenses You Can Deduct From Your Taxes Medical, Tax time Are Hospital Bills Tax Deductible you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). claiming medical expense deductions on your tax return is one way to lower your tax bill. medical expenses are the costs to treat or prevent an injury or disease,. Are Hospital Bills Tax Deductible.

From clearhealthcosts.com

How to read a bill or explanation of benefits Know the tricks Are Hospital Bills Tax Deductible While you can receive a. claiming medical expense deductions on your tax return is one way to lower your tax bill. you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). medical expenses are the costs to treat or. Are Hospital Bills Tax Deductible.

From help.taxreliefcenter.org

Is Health Insurance Tax Deductible? Get the Answers Here Are Hospital Bills Tax Deductible if you recently spent thousands on hospital bills or physical therapy, you may be wondering if you qualify for any deductions. for 2023 tax returns filed in 2024, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their. claiming medical expense deductions on your tax return is one way to lower your tax. Are Hospital Bills Tax Deductible.

From hospitalshub.com

Can Hospital Bills Be a Tax Deduction? A Comprehensive Guide Are Hospital Bills Tax Deductible claiming medical expense deductions on your tax return is one way to lower your tax bill. you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). if you recently spent thousands on hospital bills or physical therapy, you may. Are Hospital Bills Tax Deductible.

From invoicemaker.com

Medical Invoice Template Invoice Maker Are Hospital Bills Tax Deductible claiming medical expense deductions on your tax return is one way to lower your tax bill. if you recently spent thousands on hospital bills or physical therapy, you may be wondering if you qualify for any deductions. medical expenses are the costs to treat or prevent an injury or disease, such as health insurance premiums, hospital visits,. Are Hospital Bills Tax Deductible.

From exoqzidrt.blob.core.windows.net

Payment Plans Hospital Bills at Gregory Sharer blog Are Hospital Bills Tax Deductible claiming medical expense deductions on your tax return is one way to lower your tax bill. if you recently spent thousands on hospital bills or physical therapy, you may be wondering if you qualify for any deductions. you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more. Are Hospital Bills Tax Deductible.

From technewinvoicetemplate.blogspot.com

Hospital Receipt Sample Invoice Template Are Hospital Bills Tax Deductible if you recently spent thousands on hospital bills or physical therapy, you may be wondering if you qualify for any deductions. for 2023 tax returns filed in 2024, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their. While you can receive a. medical expenses are the costs to treat or prevent an. Are Hospital Bills Tax Deductible.

From carrington.edu

Medical Tax Breaks & Deductions An Untapped Advantage Carrington.edu Are Hospital Bills Tax Deductible claiming medical expense deductions on your tax return is one way to lower your tax bill. you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). medical expenses are the costs to treat or prevent an injury or disease,. Are Hospital Bills Tax Deductible.

From finance.yahoo.com

How to Get Help With Your Medical Bills Are Hospital Bills Tax Deductible claiming medical expense deductions on your tax return is one way to lower your tax bill. if you recently spent thousands on hospital bills or physical therapy, you may be wondering if you qualify for any deductions. medical expenses are the costs to treat or prevent an injury or disease, such as health insurance premiums, hospital visits,. Are Hospital Bills Tax Deductible.

From www.healthgrades.com

How to Get Help With Your Medical Bill Are Hospital Bills Tax Deductible medical expenses are the costs to treat or prevent an injury or disease, such as health insurance premiums, hospital visits, and. you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). While you can receive a. for 2023 tax. Are Hospital Bills Tax Deductible.

From www.lexmed.com

Hospital Bills at Lexington Medical Center Columbia, SC Hospital Are Hospital Bills Tax Deductible medical expenses are the costs to treat or prevent an injury or disease, such as health insurance premiums, hospital visits, and. claiming medical expense deductions on your tax return is one way to lower your tax bill. While you can receive a. for 2023 tax returns filed in 2024, taxpayers can deduct qualified, unreimbursed medical expenses that. Are Hospital Bills Tax Deductible.

From nighthelper.com

Tips on Consolidating the Medical Bills. Are Hospital Bills Tax Deductible for 2023 tax returns filed in 2024, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their. you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). claiming medical expense deductions on your tax return. Are Hospital Bills Tax Deductible.

From www.straighttalkla.com

Too Important to Settle for Assumptions… (How Coinsurance Works Are Hospital Bills Tax Deductible if you recently spent thousands on hospital bills or physical therapy, you may be wondering if you qualify for any deductions. medical expenses are the costs to treat or prevent an injury or disease, such as health insurance premiums, hospital visits, and. claiming medical expense deductions on your tax return is one way to lower your tax. Are Hospital Bills Tax Deductible.

From activitycovered.com

How to Pay Your Northside Hospital Bill Online A StepbyStep Guide Are Hospital Bills Tax Deductible you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income (agi). medical expenses are the costs to treat or prevent an injury or disease, such as health insurance premiums, hospital visits, and. While you can receive a. claiming medical expense. Are Hospital Bills Tax Deductible.

From www.grantsformedical.com

Are Medical Expenses Tax Deductible? 10 Deductible Expenses Are Hospital Bills Tax Deductible if you recently spent thousands on hospital bills or physical therapy, you may be wondering if you qualify for any deductions. While you can receive a. medical expenses are the costs to treat or prevent an injury or disease, such as health insurance premiums, hospital visits, and. claiming medical expense deductions on your tax return is one. Are Hospital Bills Tax Deductible.

From www.5newsonline.com

Confused About Medical Bills? Here’s How To Understand Your Expenses Are Hospital Bills Tax Deductible claiming medical expense deductions on your tax return is one way to lower your tax bill. if you recently spent thousands on hospital bills or physical therapy, you may be wondering if you qualify for any deductions. you can deduct on schedule a (form 1040) only the part of your medical and dental expenses that is more. Are Hospital Bills Tax Deductible.

From hospital-bill-pdf.pdffiller.com

Hospital Bill Format Fill Online, Printable, Fillable, Blank pdfFiller Are Hospital Bills Tax Deductible if you recently spent thousands on hospital bills or physical therapy, you may be wondering if you qualify for any deductions. for 2023 tax returns filed in 2024, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their. you can deduct on schedule a (form 1040) only the part of your medical and. Are Hospital Bills Tax Deductible.